Hs code malaysia pdf 2018 sst With this modification of the exemption it is important that the manufacturers of the useful products exemptly evaluate themselves if the manufactured products will be affectedã when pertinent rapid measures must be taken to update applied exemptions or To apply the Updated Services Fiscal Guidelines the Royal. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat ccccustomsgovmy.

Up to 24 cash back Hs code malaysia pdf 2018 sst EStream Software tariff classification is a complex but extremely important aspect of cross-border trade.

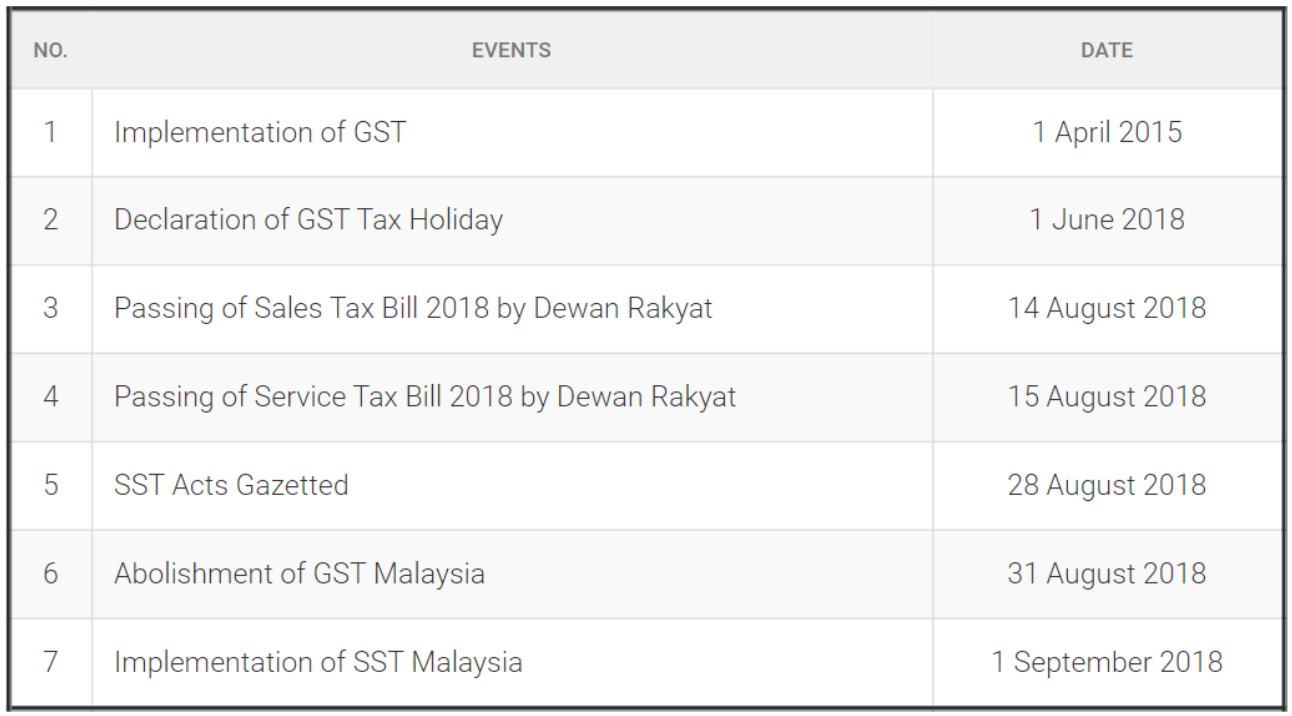

. Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia. Sales tax was reinstated on 1 September 2018 as Malaysia moved away from the former GST regime. 4 digit pertama disebut sebagai Tajuk.

The codes created by the World Customs Organization WCO classify up to. 2 digit pertama dari HS Code disebut sebagai Bab. This is in conjunction with the implementation of the new Customs operating system uCustoms where.

Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. 6-digit Cargo Harmonized System HS code to be stated clearly in the shipping instructions. Per Unit INR Nov 22 2016.

Falling under the HS tariff code 87120030 00 are subject to import duty at the rate of 25. Sales tax is a single stage tax with no credit mechanism. Exempt goods and goods taxable at 5 are defined by the HS tariff code of the goods as prescribed in a gazette order.

People Accounting Academy Sales Inventory Accounting. 6 digit disebut sebagai Sub-Tajuk. Wednesday October 3 2018.

Alder ash alder beech birch cherry chestnut elm eucalyptus hickory horse chestnut basswood. 4202 3100 90 Wallets or purses referring to articles of a kind normally carried in the pocket or in the handbagwith outer surface of leather or of composition leather. Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into the customs territory of the US under the terms of US.

Artikel ini memberikan maklumat umum mengenai proses klasifikasi. We intend to claim rewards under meis falling under sr. Please note the following when submitting your shipping instructions.

June 2018 is the FY ending 30 June 2018. Malaysia - Imports and Exports - World - Total of all HS commodities - Value MYR - 2013 - 2021-Q4. Visit us online to get.

Anda juga boleh membaca klasifikasi panduan terperinci kami. HS Code Description Base Rate 2005 MFN 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years 01 Live animals 0101 Live horses asses. Note 1 b to this subchapter.

4412 3300 90 At least one surface layer is the following non-coniferous woods. 4 digit pertama disebut sebagai Tajuk. Kod untuk epal adalah 0808100000 di Malaysia.

78 malaysia country group code b itc hs code 29420090. To maintain the single stage nature of the tax several exemption. MALAYSIA - Mandatory HS 6-digits commodity code Dear Valued Customers Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory to apply the 6-digits HS Code to be declared in the Export Import and Transhipment manifest in Malaysia.

It is a product-specific code as stated in the Harmonised SystemHS maintained by the World. Declaration Norm 0Brand type1Export preferences2Type wallet wallet mobile phone case etc3Surface material leather. Galvanised transmission line tower parts thereof.

170330 Malaysia to Implement New HS Codes 2017 Effective April 1 2017 Malaysia will abolish the Customs Duty Order PDK and adopt the ASEAN Harmonized. Share Please be informed that the Royal Malaysian Customs Department have announced that with effect from 1st October 2018 it is mandatory for the 6 digit HS Code to be declared in the Export Import and transshipment manifest in Malaysia. Genoa 03rd October 2018 Subject.

Especially where two or more HS codes may be applied you may want to check first with customs in the target countryThe full 2-digit HS codes listHS Code4 digit categoriesProduct descriptions10101 0106Live animals20201 0210Meat and edible meat offal30301 0307Fish and crustaceans. This is in conjunction with the implementation of the new Customs operating. Materials certified to the Commissioner of Customs by.

CIQ Code 999Non-Childrens Bags. SST was re-introduced on 1 Sep 2018. Malaysia adopts a self-assessment system which means that the responsibility to determine the correct tax liability lies with the taxpayer.

Dear Valued Customers. IT Origin Country Tariff. YAMAHA AV RECEIVER RX-V481 BLACK L MALAYSIA ZT38670.

Trying to get tariff data. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

On 2 November 2018 the Malaysia Minister of Finance tabled the 2019 National Budget. With effect from 1 st October 2018 the Royal Malaysian Customs Department requires the 6-digit HS code to be submitted during importexport manifest declaration. Effective from 1 January 2019 import duty rate is proposed to.

Description 2013 2014 2015 2016 2017 2018 2019 2020 and subsequent years Annex 1 Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0. Goods imported from Malaysia or Malaysia are classified under the Agreed Tariff Schedule HTS or are commonly referred to as GS codes. All income of persons other than a company limited liability partnership co-operative or trust body are assessed on a calendar year basis.

Find out everything you need to know about SST in Malaysia as a small business owner.

Kfc Special Deal Online Coupon

School Locker Abs Plastic School Waterproof Swimming Pool Locker

Pdf A Global Map Of Mangrove Forest Soil Carbon At 30 M Spatial Resolution

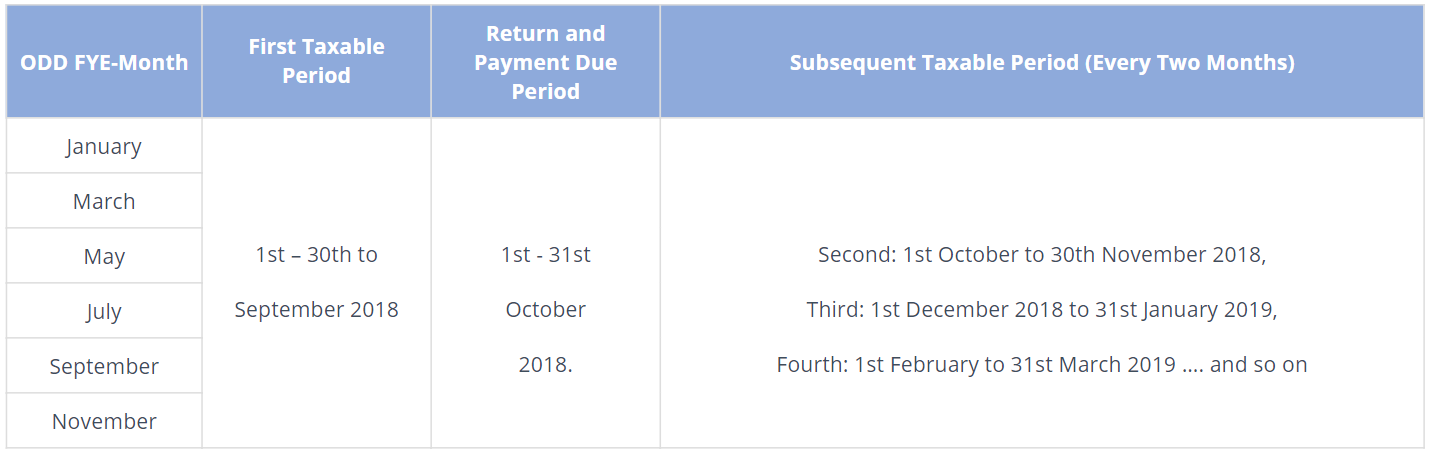

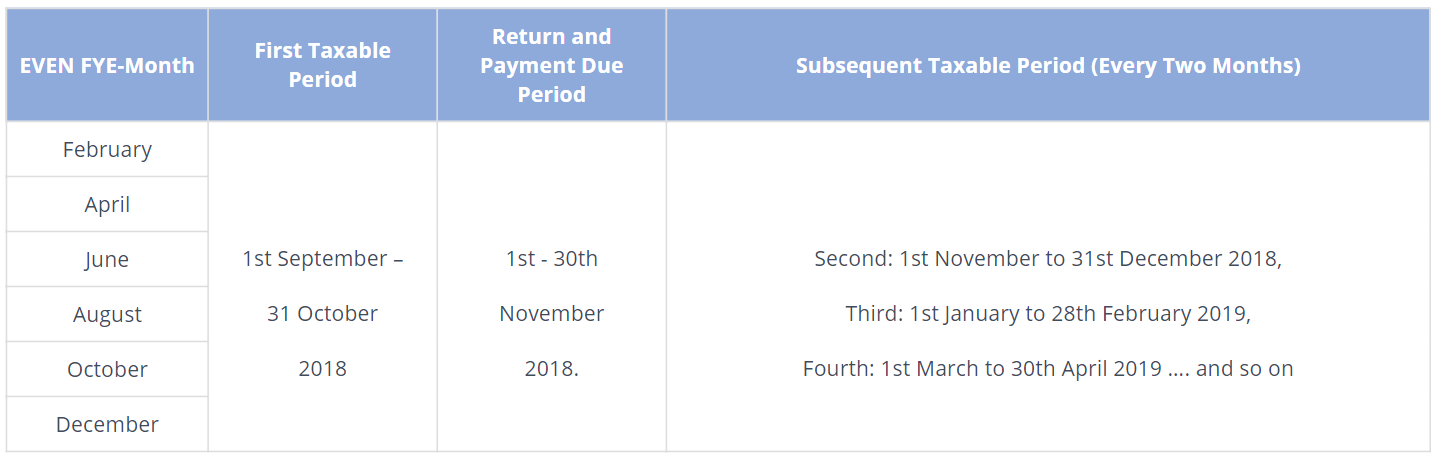

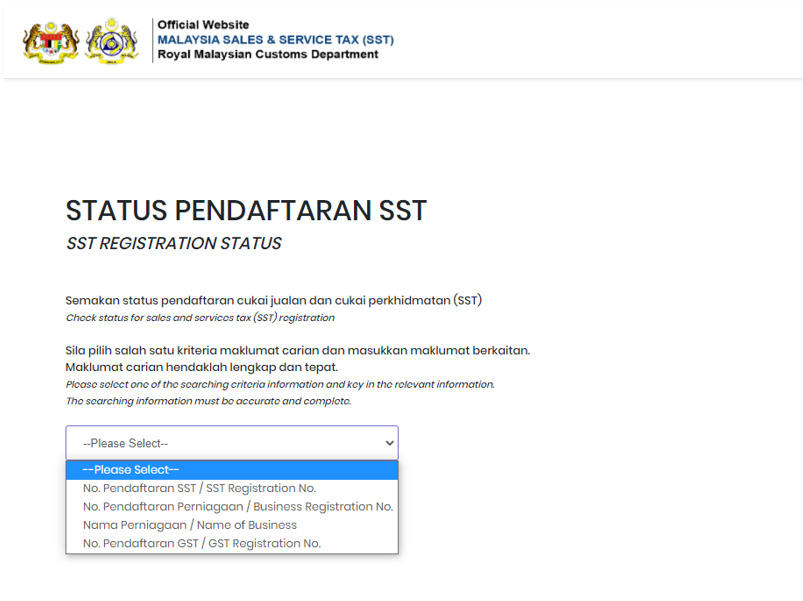

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Jom Tapau Golf Resort Signature Dishes Resort

Msu Celebrates 1 871 Graduates Msu College Msu University

Get Your Free Rm8 Reload Pin Now

Crocodile Singapore Warehouse Sale Up To 80 Off Promotion 21 Dec 2018 6 Jan 2019 Why Not Deals

Malaysia Sst Sales And Service Tax A Complete Guide

Pin By Msu Malaysia On University News Baseball Cards Baseball Cards

Malaysia Sst Sales And Service Tax A Complete Guide

Regional Input Output Tables Asian Development Bank